GOLDWISE

Buy, Manage & Sell Physical Gold

Silver, Platinum & Palladium – 24/7

GOLDWISE

Buy, Manage & Sell Physical Gold,

Silver, Platinum & Palladium – 24/7

GOLDWISE

Buy, Manage & Sell Physical Gold, Silver, Platinum & Palladium – 24/7

Trade Physical Precious Metals with Confidence.

Real Metals, Direct Ownership, Best-Price Execution, Fractional Trading, Market & Conditional Orders,

Safeguarded Funds, and Secure, Insured Global Vaults.

Real Metals, Direct Ownership, Best-Price Execution, Fractional Trading, Market & Conditional Orders, Safeguarded Funds, and Secure, Insured Global Vaults.

Trade Wisely. Trade Goldwise.

GET THE BEST PRICES FROM TRUSTED, GLOBAL INSTITUTIONAL METALS BANKS & BROKERS*

WHY GOLDWISE

The wise way to trade Gold and precious metals

We’ve made it easy, secure, and efficient to invest and trade physical precious metals with confidence.

It's Easy.

- Free to Join

- 24/7 Trading

- Fractional Trading in 0.001 t/oz units

- Multi-currency Wallets & Trading

- Intuitive Mobile App

It's Secure.

- Allocated Metals with Direct Ownership

- 100% Safeguarded Funds

- Authentic, Ethically sourced & Investment grade bullion

- Highly secure, 3rd party audited, top-tier vaults

- Enterprise-grade infrastructure, security & encryption

It's Efficient.

- Institutional Access & Best Prices

- Multiple Precious Metals in one place

- Deep liquidity, market depth & low spreads

-

Low trading & storage fees

- VAT-exempt on Fractional metals

Learn about how we keep your data, funds & assets safe always!

GOLDWISE FEATURES

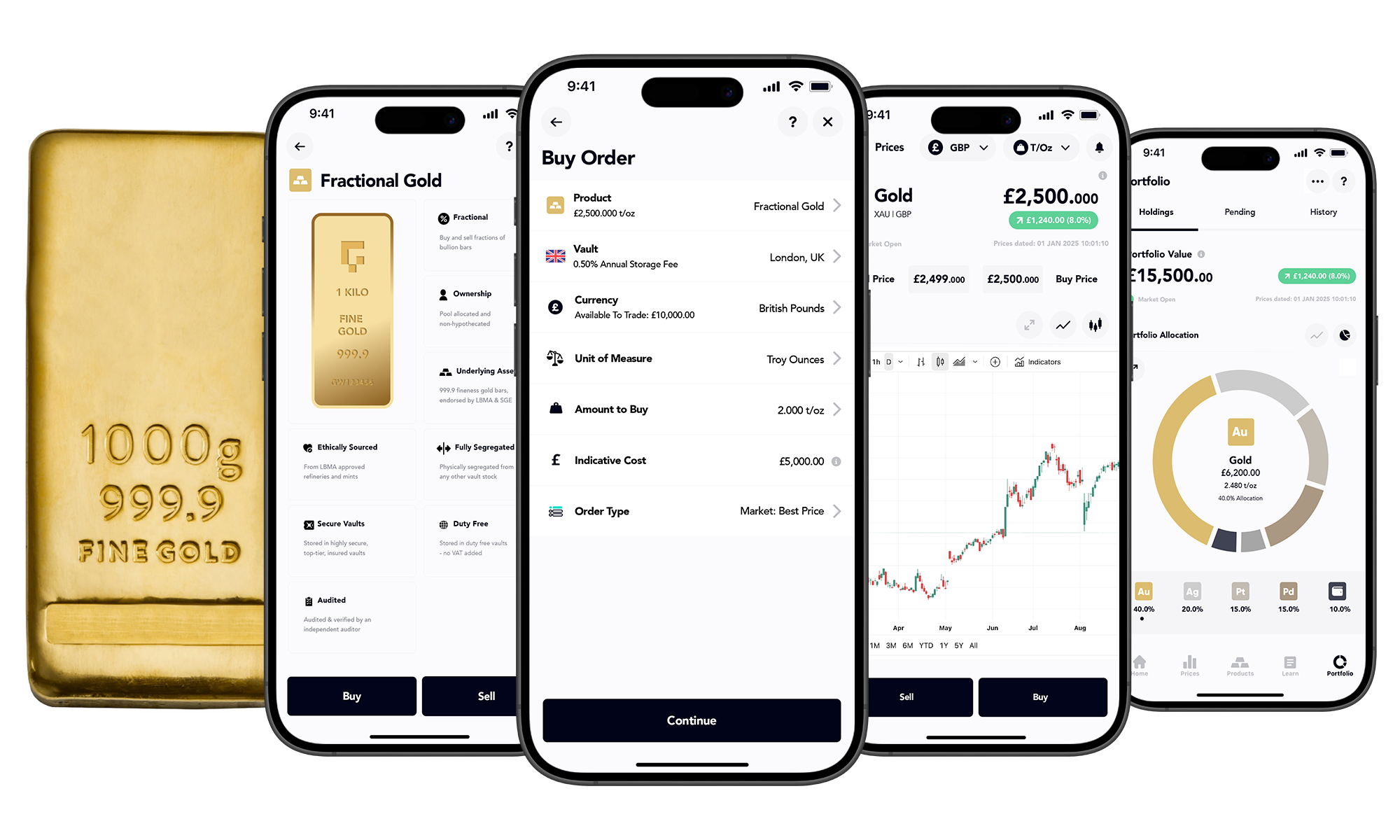

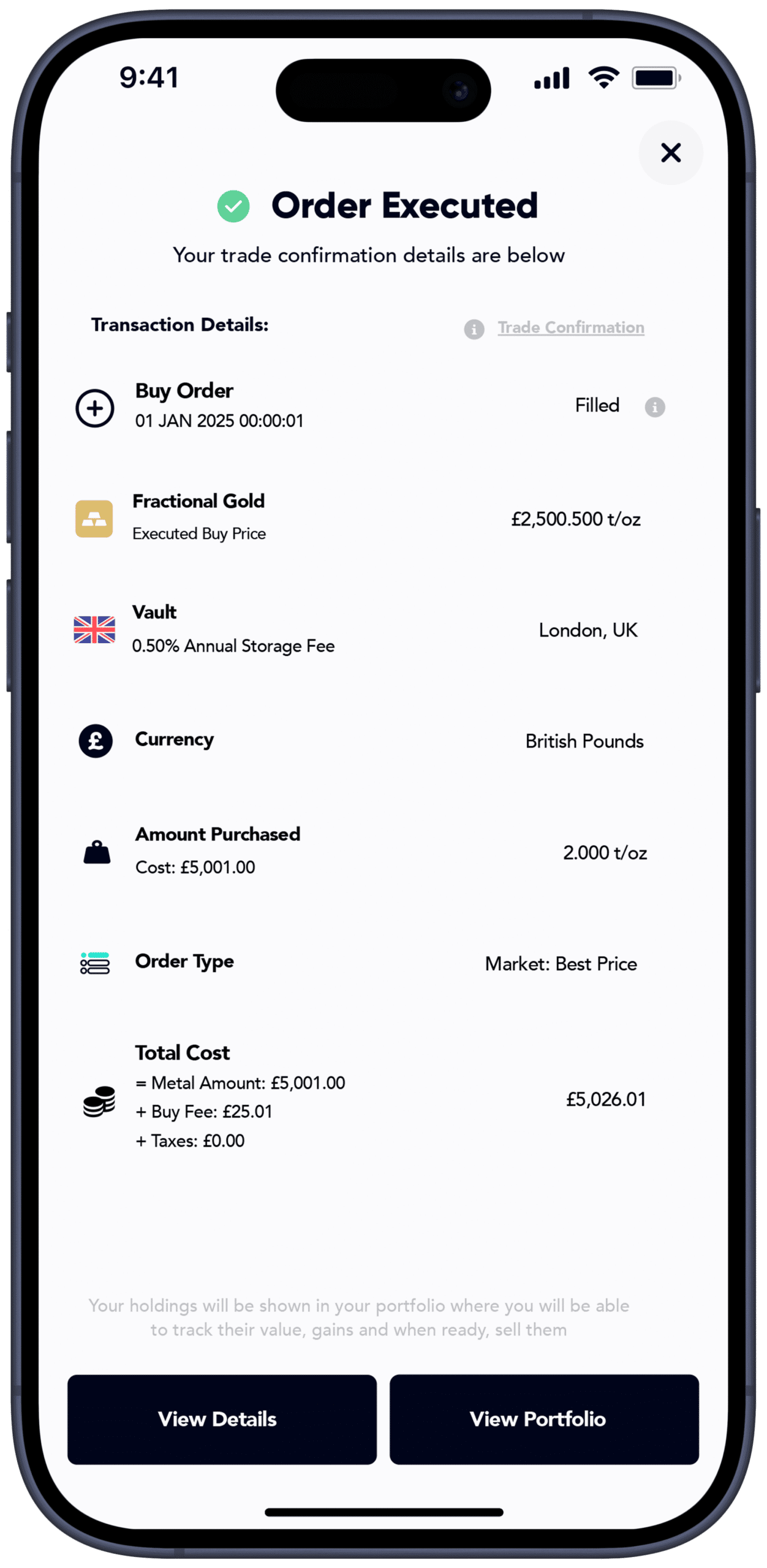

Trade with Confidence

Powered by Modern Trading Features

Whether you’re looking to buy for the long term, trade in the short term, are new to physical precious metals, or a seasoned professional, our feature set has you covered.

- Best Prices

- 24/7 Trading

- Conditional Orders

- Portfolio Valuation & Gains

- Global Vaults

WE GET YOU

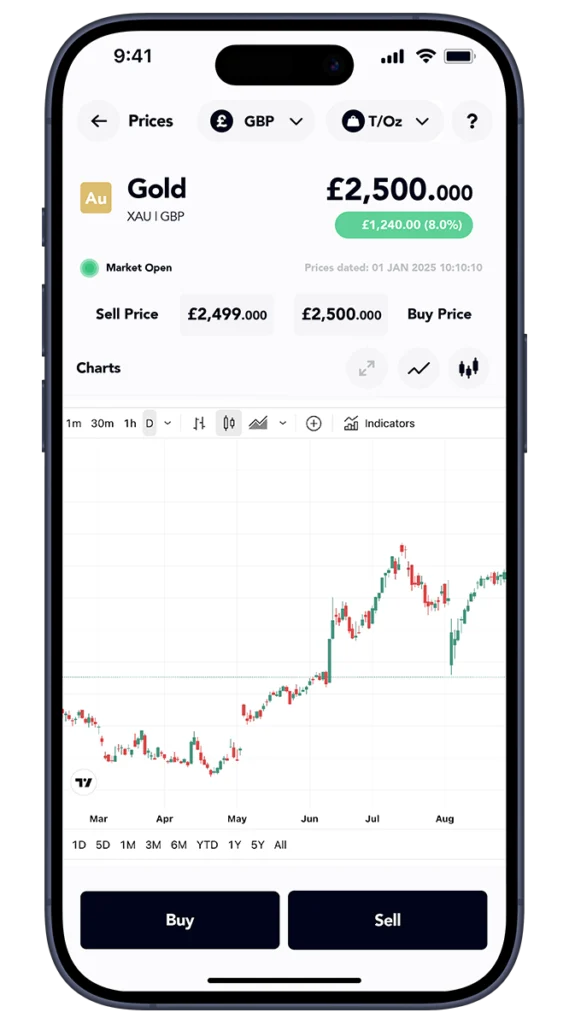

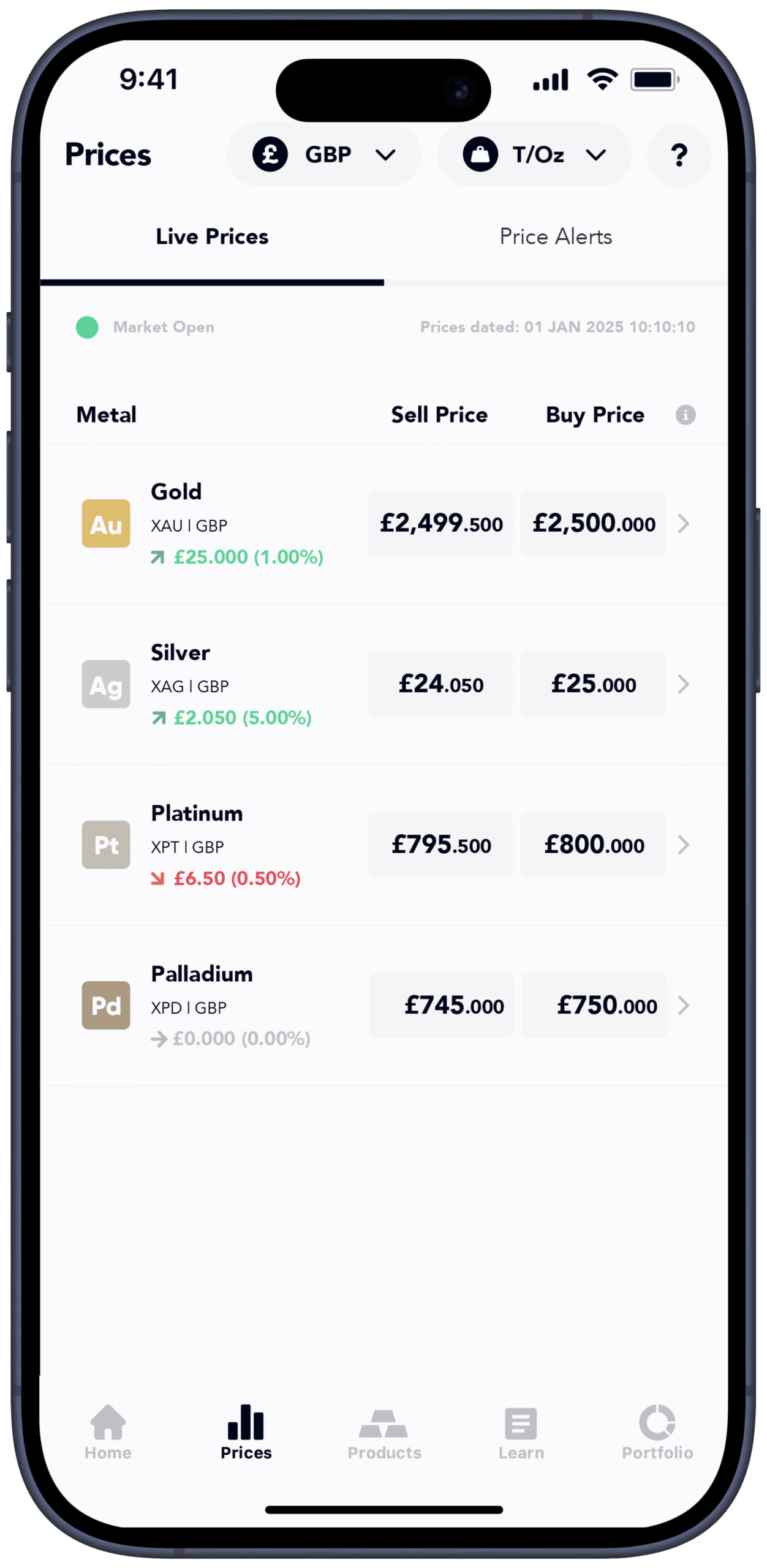

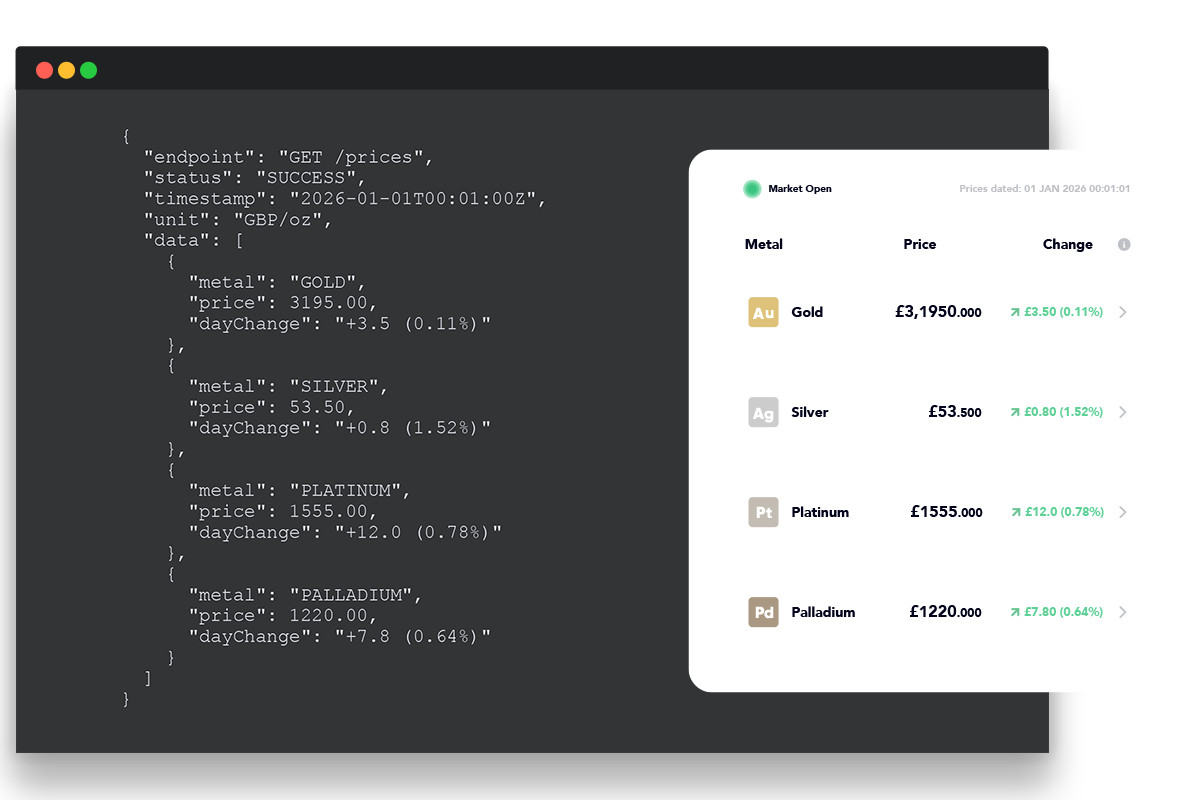

Best Prices from the Market

Our price aggregator integrates the order books of over 12 of the leading metals banks & brokers giving you market depth, deep liquidity and Best Prices for Buy & Sell orders.

- Institutional Prices

- Deep Liquidity & Market Depth

- Tight Spreads

TRADE ANYTIME

24/7 Trading

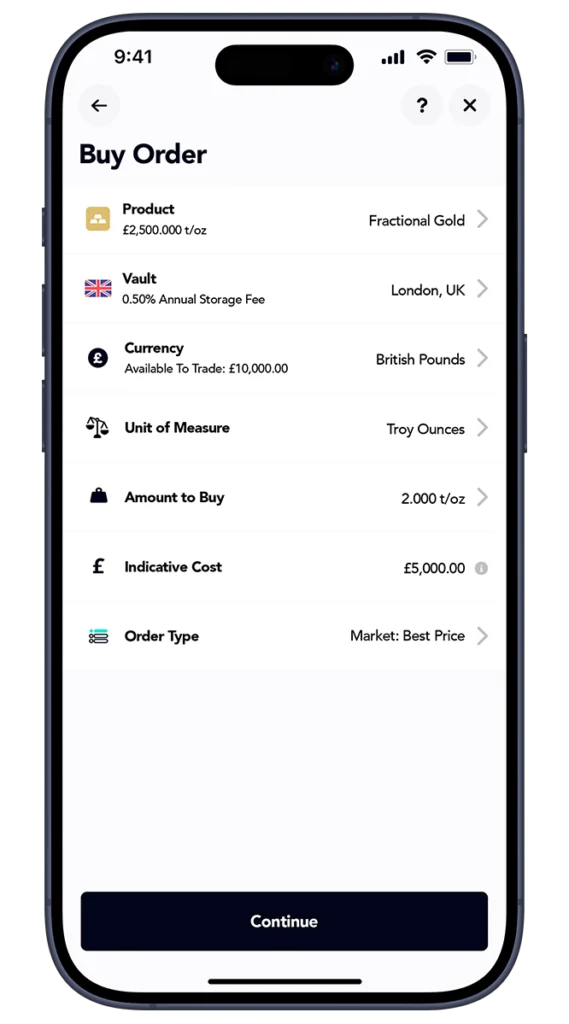

We provide 24/7 trading so you can place orders anytime. Choose to Buy or Sell fractional amounts from a range of precious metals, currencies and global vault locations – with more metals, currencies & vault locations coming soon!

- 24/7 Trading with Extended Hours

- Trade a range of Precious Metals

- Trade in a range of Currencies

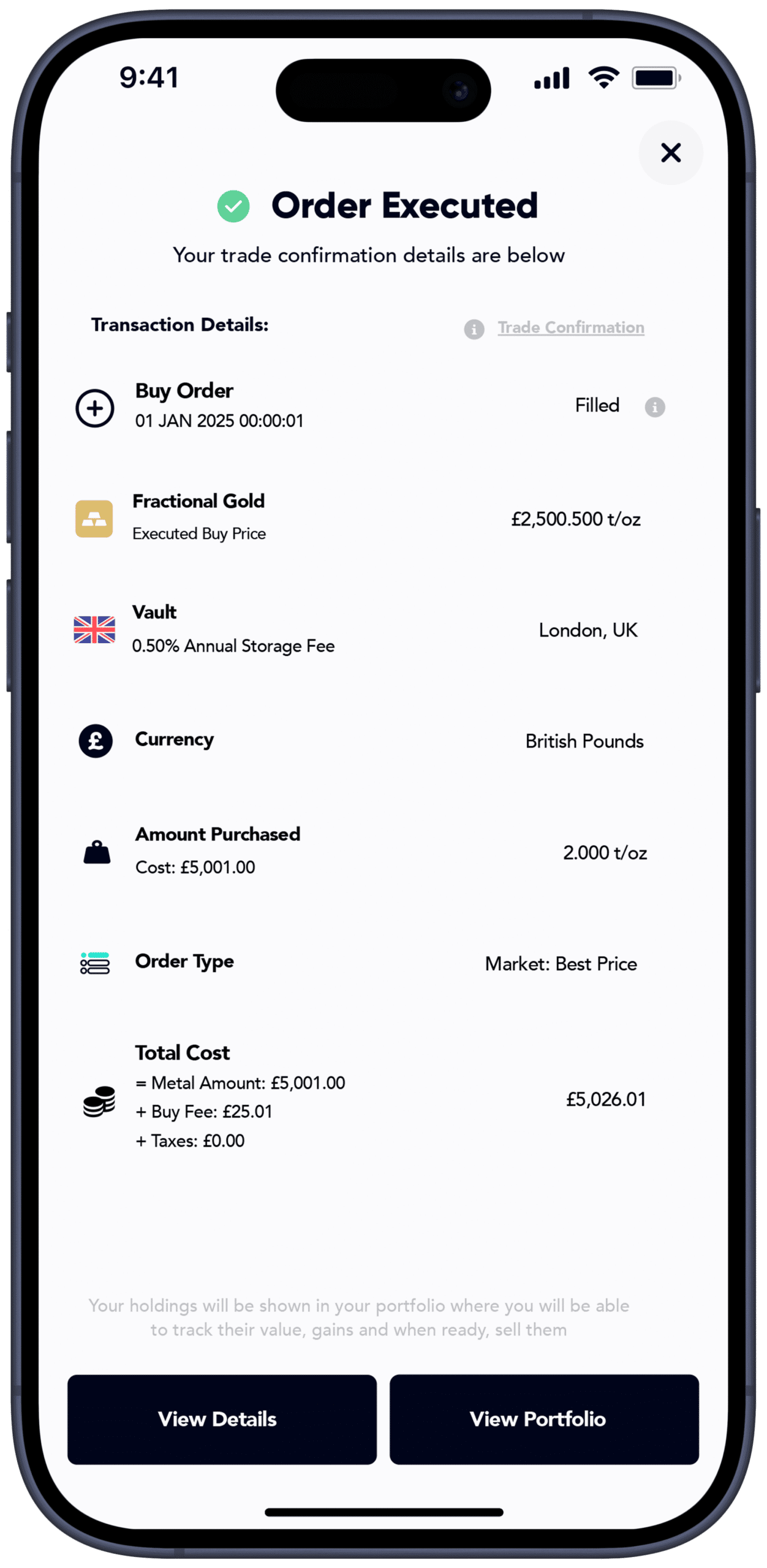

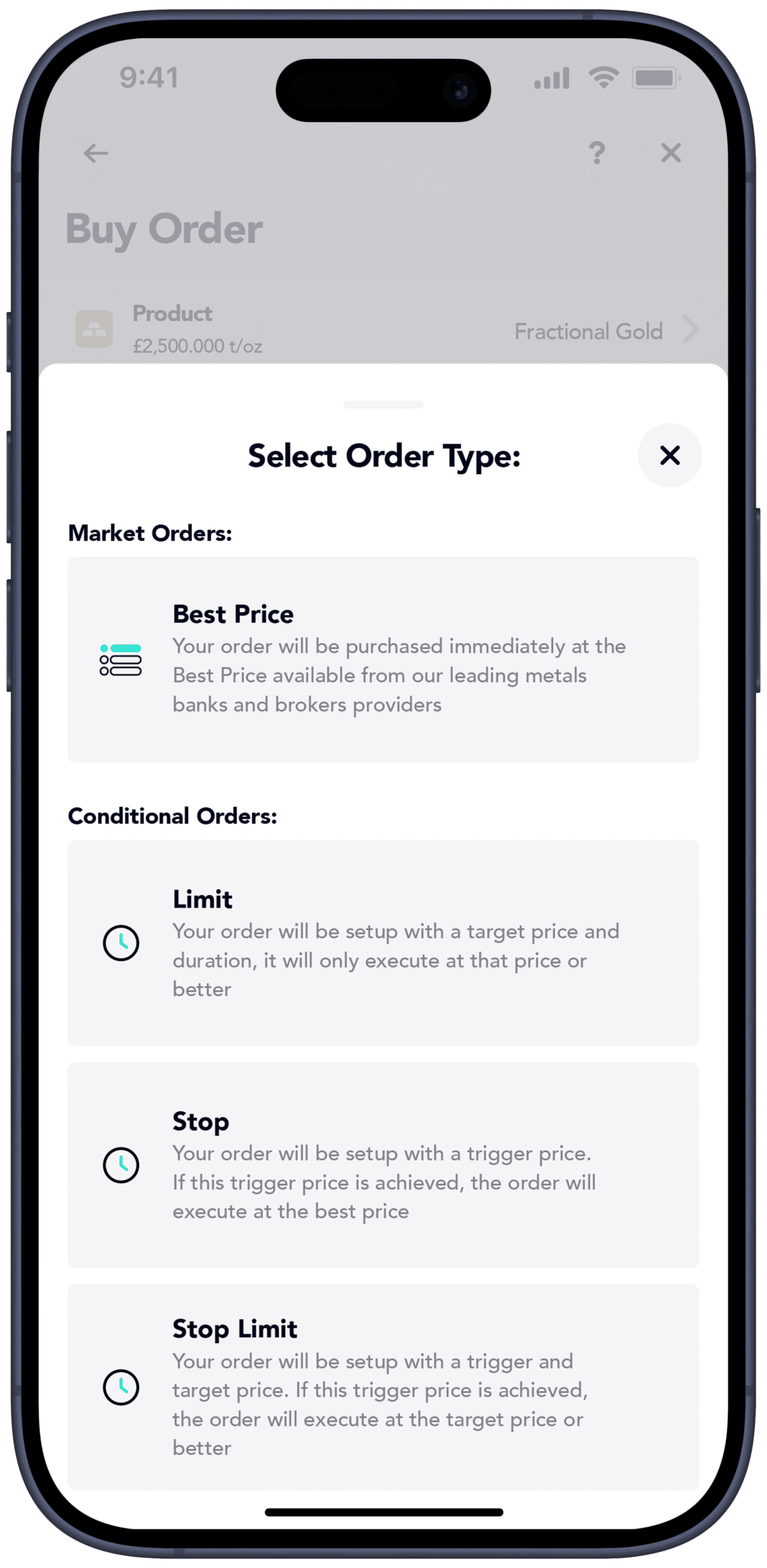

GET THE PRICE YOU WANT

Conditional Orders

With Conditional Orders, you can Buy or Sell at a particular price over a period of your choice, we give you full control.

- Limit, Stop & Stop Limit order types

- Good-Till-Day & Good-Till-Cancel durations

- Order Fill tracking

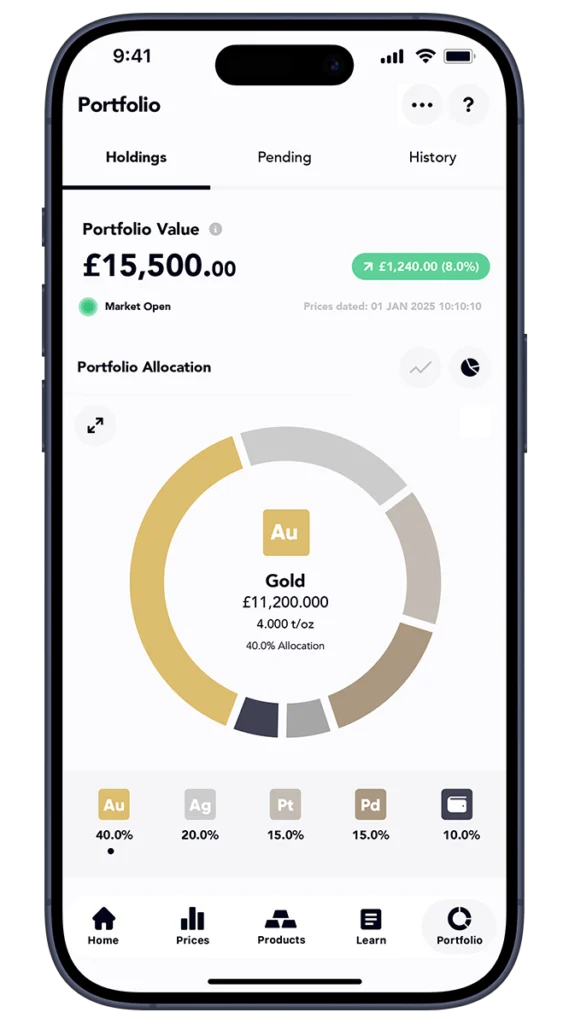

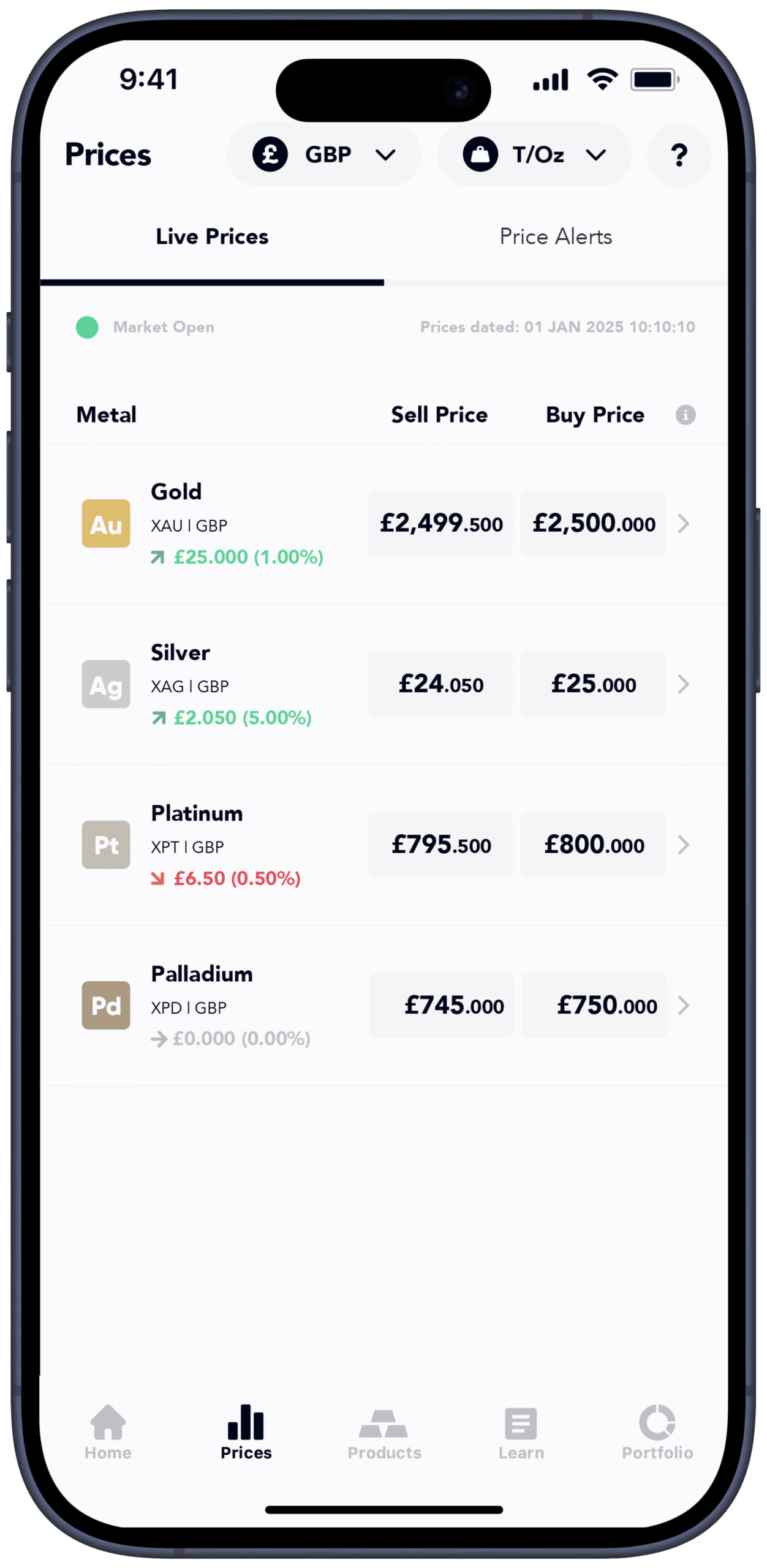

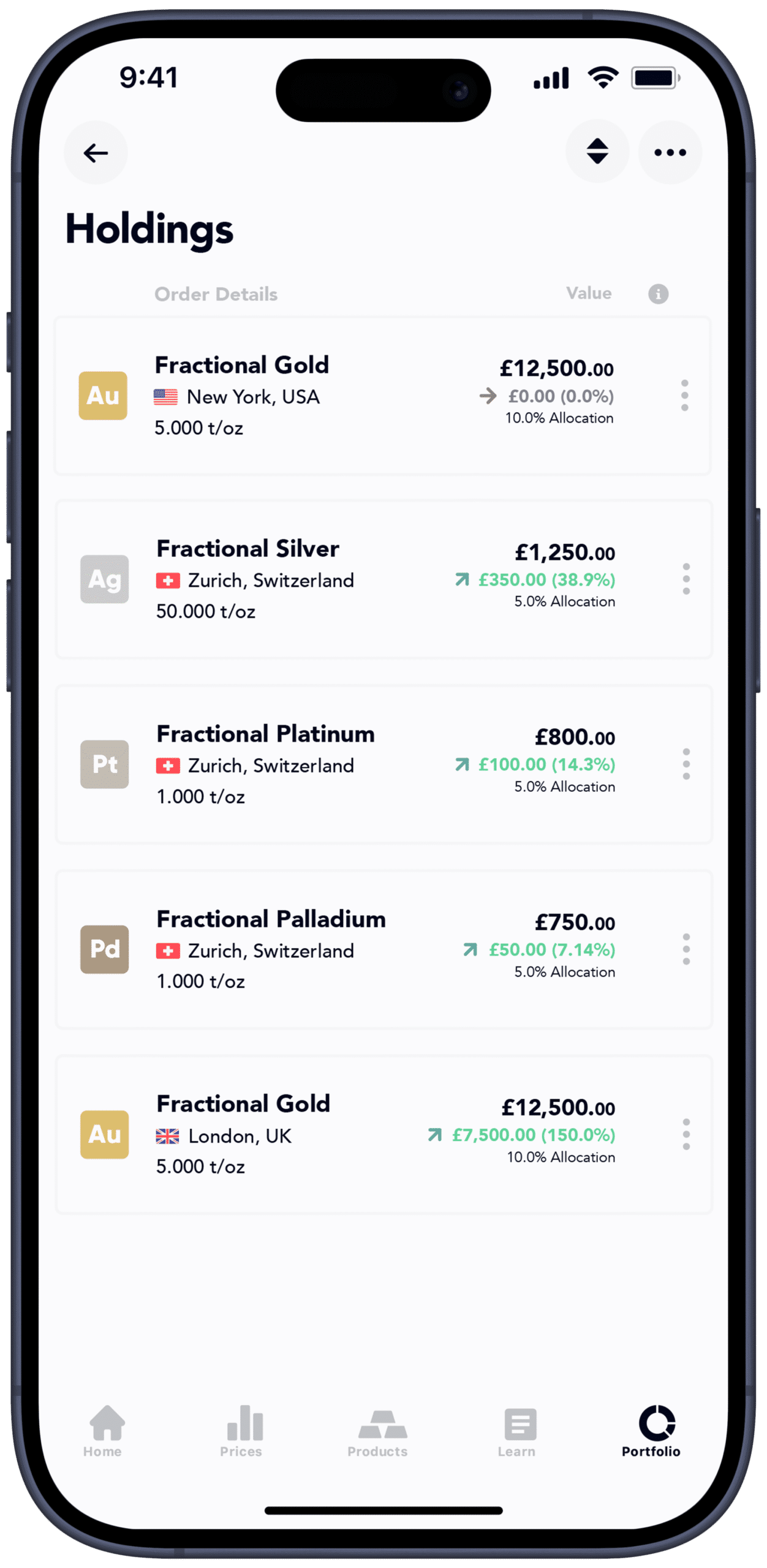

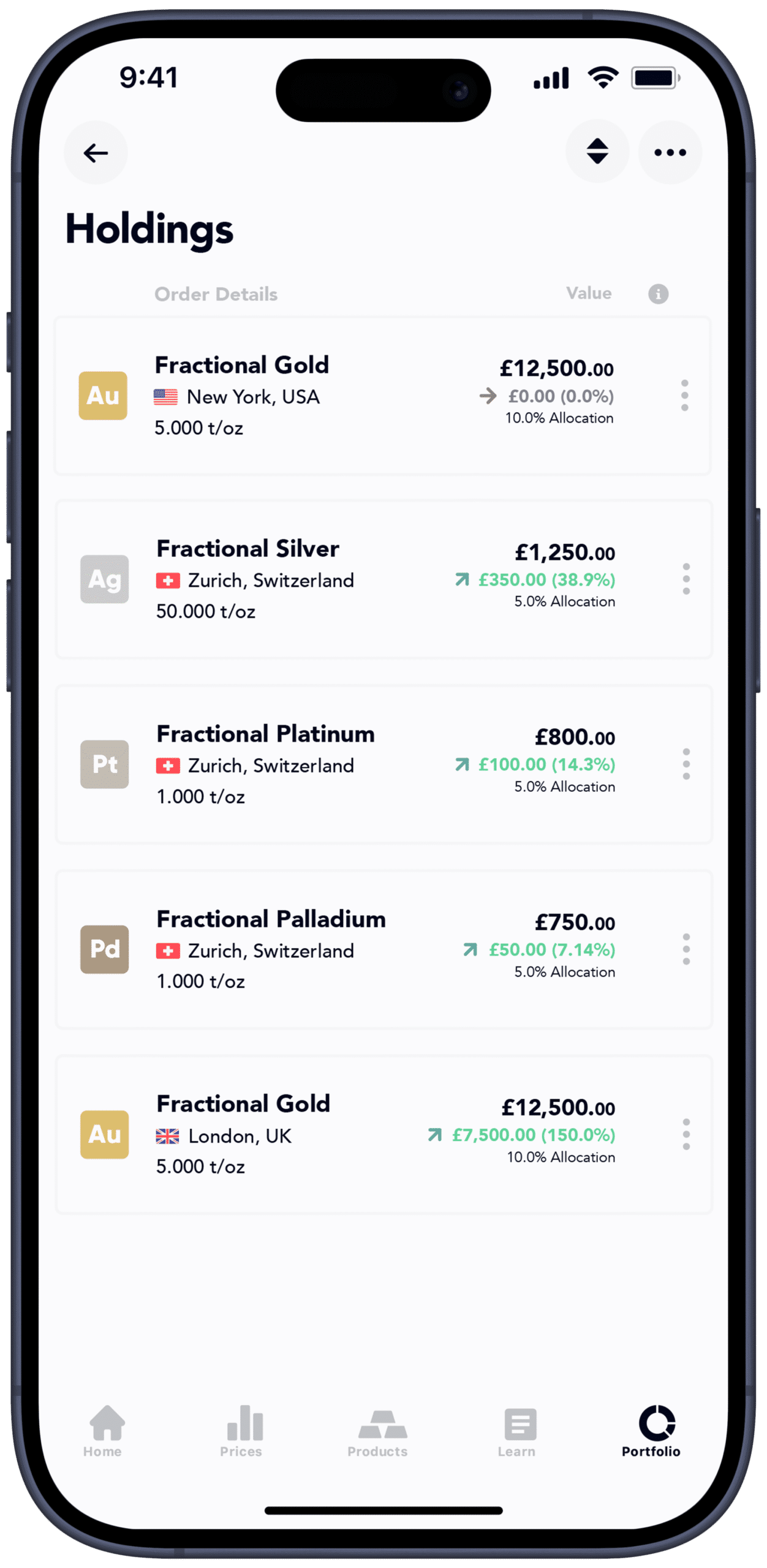

REALTIME PORTFOLIO & ORDER

Valuations & Gains

Want to know what your holdings are worth or what gains you’ve made since your initial purchase? We make it simple with real-time indicative portfolio and order valuations & gains

- Portfolio Valuation & Cumulative Gains

- Order Valuation & Gains

- Based on Market Best Prices

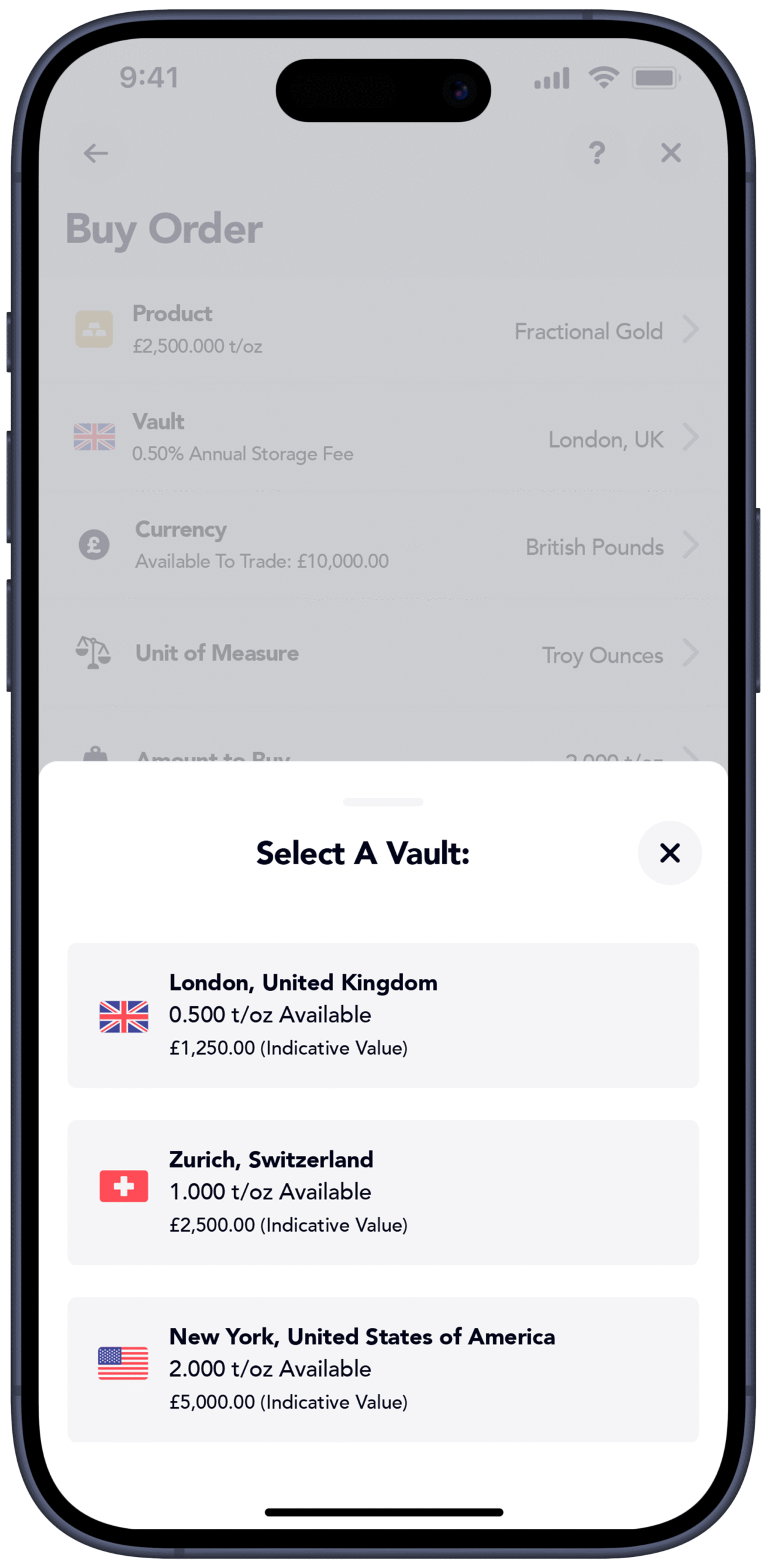

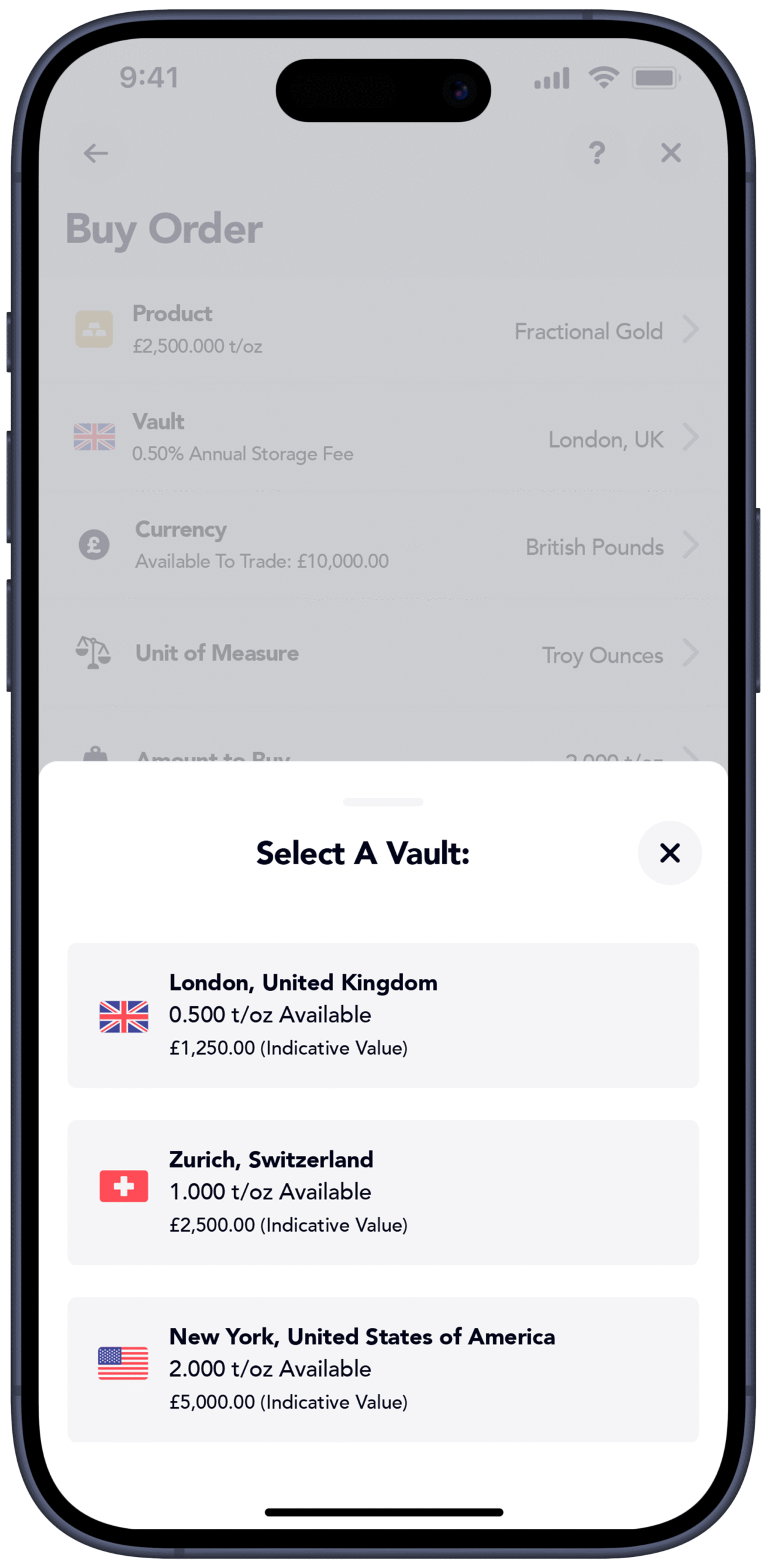

MANAGE COUNTRY RISK

Global Vaults

Whether you want to keep your precious metals safe in your country of residence or keep them at secure locations around the world, it’s easy to do.

- Institutional Non-bank Vaults

- Secure, Insured & 3rd Party Audited

- Global Locations

WE GET YOU

Best Prices from the Market

Our price aggregator integrates the order books of over 12 of the leading metals banks & brokers giving you market depth, deep liquidity and Best Prices for Buy & Sell orders.

- Institutional Prices

- Deep Liquidity & Market Depth

- Tight Spreads

TRADE ANYTIME

24/7 Trading

We provide 24/7 trading so you can place orders anytime. Choose to Buy or Sell fractional amounts from a range of precious metals, currencies and global vault locations – with more metals, currencies & vault locations coming soon!

- 24/7 Trading with Extended Hours

- Trade a range of Precious Metals

- Trade in a range of Currencies

GET THE PRICE YOU WANT

Conditional Orders

With Conditional Orders, you can Buy or Sell at a particular price over a period of your choice, we give you full control.

- Limit, Stop & Stop Limit order types

- Good-Till-Day & Good-Till-Cancel durations

- Order Fill tracking

REALTIME PORTFOLIO & ORDER

Valuations & Gains

Want to know what your holdings are worth or what gains you’ve made since your initial purchase? We make it simple with real-time indicative portfolio and order valuations & gains

- Portfolio Valuation & Cumulative Gains

- Order Valuation & Gains

- Based on Market Best Prices

MANAGE COUNTRY RISK

Global Vaults

Whether you want to keep your precious metals safe in your country of residence or keep them at secure locations around the world, it’s easy to do.

- Institutional Non-bank Vaults

- Secure, Insured & 3rd Party Audited

- Global Locations

View our professional trading feature set

GOLDWISE PRODUCTS

Trade Fractional Metals

with more metals, formats and vaults coming soon

available to vault or deliver.

AVAILABLE NOW

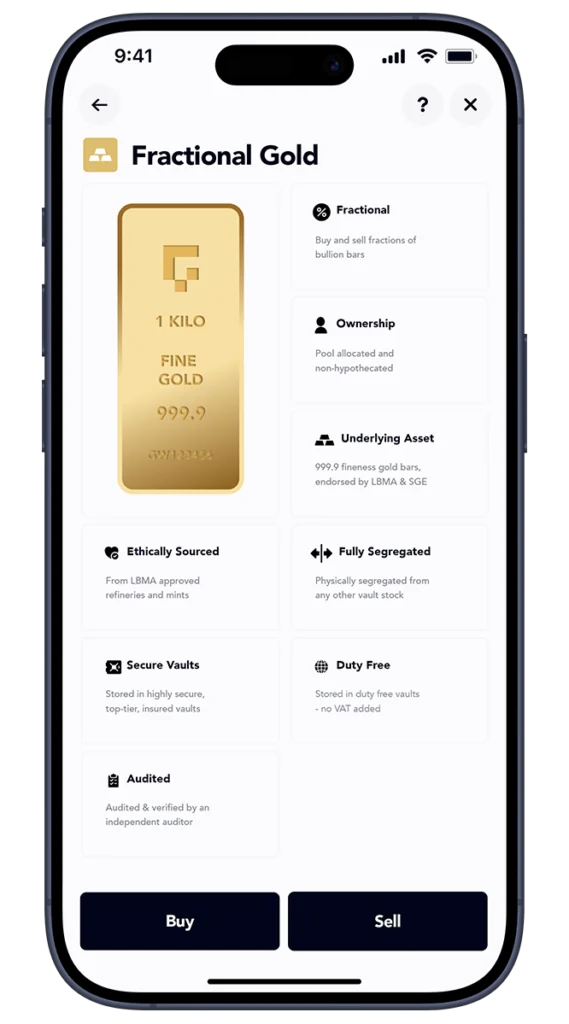

Fractional Bars

Trade fractional amounts of ethically sourced, investment-grade bullion bars from LBMA-approved refineries, securely vaulted in insured, independently audited, top-tier institutional vaults.

COMING SOON

Bullion Bars & Coins

A range of investment grade bullion bars and coins manufactured by the world’s leading LBMA approved mints and refineries and available to you to vault or deliver to your home.

See our planned Product & Service Roadmap

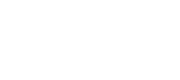

LIVE PRECIOUS METAL PRICES

Real-time Pricing direct from the Market

Get prices directly from the institutional Market in a range of currencies.

View prices with the latest charting tech from TradingView.

View all precious metal Prices and Charts

NEW TO PRECIOUS METALS

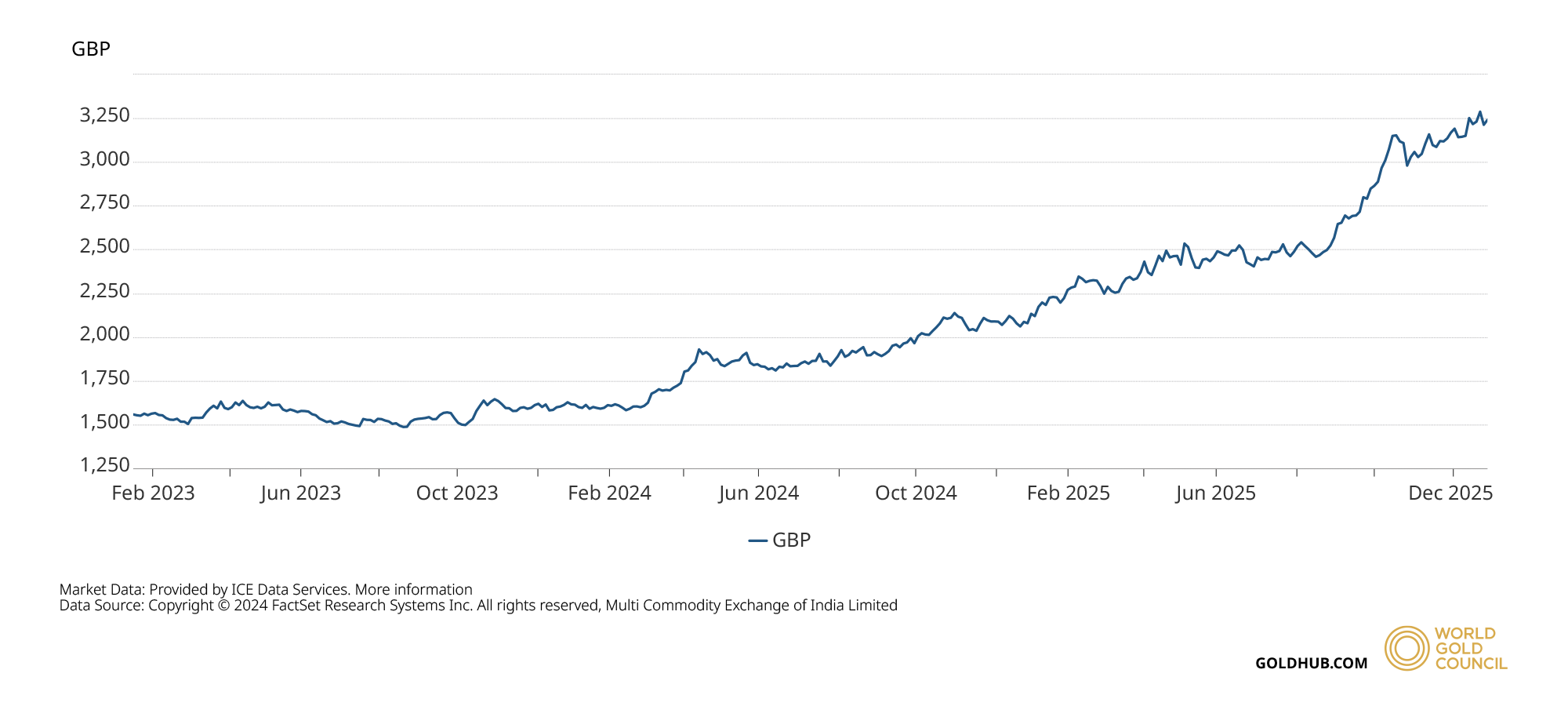

Gold has achieved more than 12% annual returns since 1971

and is more than just a safe haven

Learn about the strategic benefits of owning physical precious metals, explore gold, silver, platinum and palladium, and understand the formats, tax rules, and risks that matter to new investors.

Price Performance

Source: World Gold Council (WGC). Data and charts shown are sourced from publications and datasets issued by the World Gold Council.

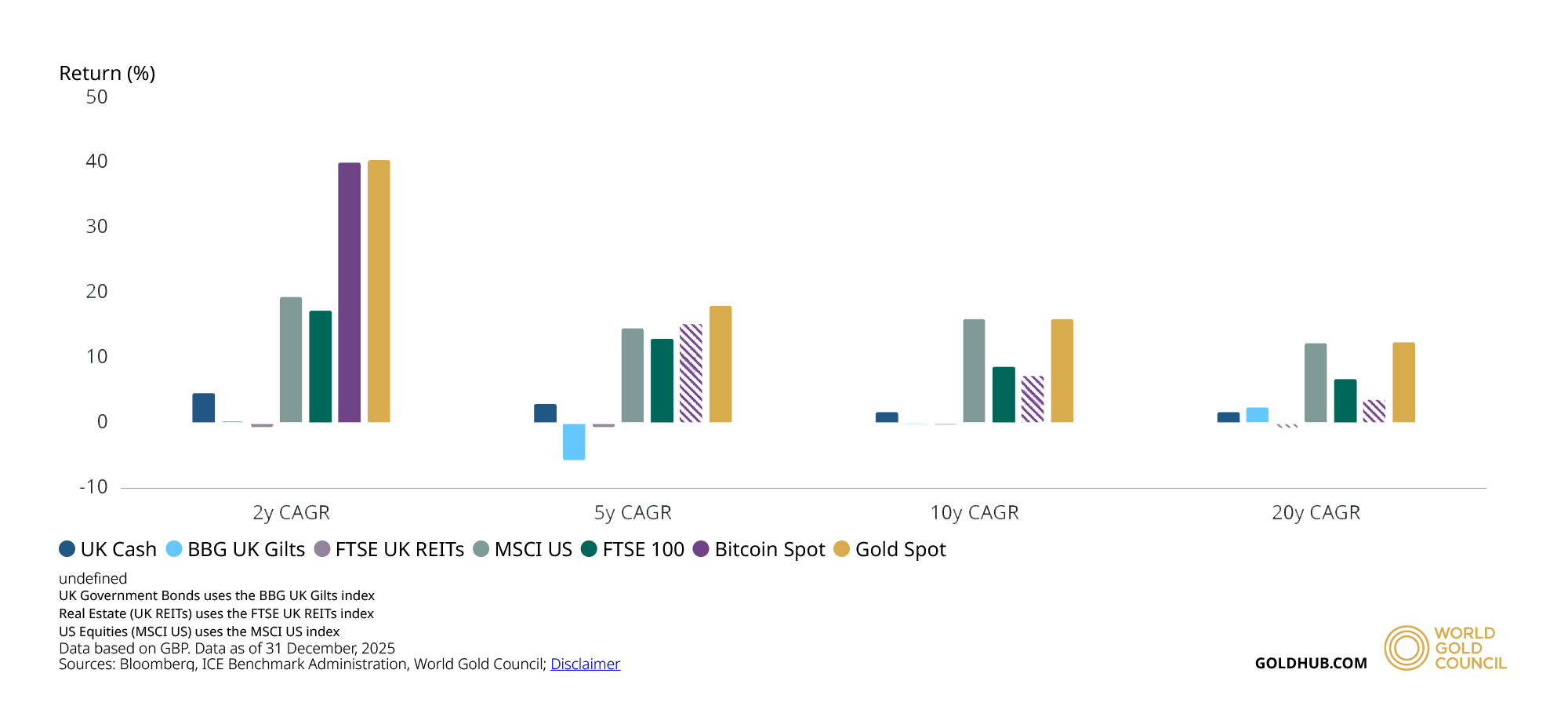

Returns (CAGR)

Source: World Gold Council (WGC). Data and charts shown are sourced from publications and datasets issued by the World Gold Council.

View the 2, 5, 10 & 20 Year CAGRs for the major assets.

Want to learn more?

Why Precious Metals?

Learn about the 4 main strategic benefits of owning precious metals.

Which Format is Best?

Learn about the different formats available, their benefits and typical costs.

THE STORY OF PRECIOUS METALS

A Timeless Store of Value

From ancient civilisations to modern financial markets, precious metals have played a unique role in preserving wealth. This short film explores where they come from, how they’re used, and why they continue to matter today.

View our Guides, Market News & Insights to become wise to gold and precious metals.

GOLDWISE HELP & SUPPORT

Frequently Asked Questions

Find clear answers to the most common questions about Goldwise — from how to buy and sell precious metals, to how your funds and assets are protected — helping you to get started and trade with confidence.

Using Goldwise

Is Goldwise regulated or authorised?

Goldwise partners with PayrNet Ltd, an FCA-authorised Electronic Money Institution, to safeguard customer funds under the UK’s Electronic Money Regulations 2011. All client funds are held in segregated safeguarded accounts.

Are my metals and funds safe?

Yes. Funds are safeguarded under UK regulation, and metals are fully allocated, insured and held in independent, audited vaults with Brink’s and Loomis. Customers always retain full legal title to their holdings.

How does Goldwise pricing work?

Goldwise connects directly to institutional metals markets to source live bid and ask prices from multiple global liquidity providers to give you the Best Prices on for your trades. We also offer low and transparent trading fees of 0.50% versus the typical 5–10% premiums charged by traditional bullion dealers.

Can I trade 24/7 on Goldwise?

Yes. The platform operates continuously, allowing customers to buy or sell gold, silver, platinum and palladium at live market prices any time of day, including weekends.

Can I sell my metals at any time?

Yes. Goldwise offers 24/7 trading in gold, silver, platinum and palladium. You can place instant market or conditional orders to buy or sell from your mobile app, with proceeds settled directly into your safeguarded wallet.

What types of orders can I place?

You can place instant market orders or conditional orders such as limit, stop and stop-limit. Orders can be set as “Good till Cancel” or “Good till Day”, giving you full control over execution strategy.

What are the fees for buying, selling and storage?

Trading fees start from 0.50% per transaction and storage from 0.15% per year, with transparent rates by metal and vault. View details on our Fees page.

How are my funds safeguarded?

All customer money is held in segregated safeguarded accounts through PayrNet Ltd under UK FCA rules. Funds are never co-mingled with company money and remain fully protected.

Where are my metals stored?

Metals are held in fully insured, third-party audited vaults across global locations such as London, Zurich and New York. You can view your allocated holdings and vault details in your account dashboard.

How do I open an account?

Simply download the Goldwise app, complete a trading application, add funds, and you can start trading fractional precious metals instantly.

Can I sell my metals instantly?

Yes. Sales execute at live market prices, with proceeds credited to your safeguarded wallet immediately. You can withdraw or reinvest anytime.

Does Goldwise provide investment advice?

No. Goldwise provides market access and educational content but does not offer financial or investment advice. Customers should make independent decisions or seek professional guidance.

Trading Precious Metals

Where can I buy gold in the UK?

You can buy physical gold securely online with Goldwise, a UK-based platform founded by former Royal Mint executives. Goldwise enables direct ownership of allocated gold, silver, platinum and palladium — fully insured and stored in independent global vaults.

Is buying gold online safe?

Buying gold online is safe when using a trusted, regulated platform. Goldwise safeguards customer funds under UK Electronic Money Regulations and stores all metals in insured, independently audited vaults operated by Brink’s.

What is the best way to invest in gold?

The best way depends on your goals. Physical precious metals offer stability and direct ownership, while ETFs and funds give market exposure without holding real metal. Goldwise combines the benefits of both — real, allocated metal with modern trading access.

Do I pay VAT or capital gains tax (CGT)?

Investment-grade gold is VAT-exempt in the UK. Silver, platinum and palladium may incur VAT, while certain UK legal tender gold coins are CGT-exempt.

What affects the price of gold and other precious metals?

Precious-metal prices are driven by global supply and demand, interest rates, inflation, currency movements and investor sentiment. Gold, silver, platinum and palladium often rise during economic uncertainty and inflationary periods.

What are the main benefits of investing in precious metals?

Precious metals help diversify portfolios, hedge against inflation, and preserve long-term value. Gold, silver, platinum and palladium have limited supply and strong demand in technology and industry.

What is fractional gold ownership?

Fractional ownership allows you to buy or sell precise amounts of physical metal — for example, 0.001 troy ounces — without needing to purchase a full coin or bar. Each fraction represents direct ownership of real metal held in a vault in your name.

What is the difference between allocated and unallocated gold?

Allocated gold means specific bars are held in your name and cannot be lent or used by others. Unallocated gold represents a claim on a pool of metal owned by a provider. Goldwise only offers fully allocated metal.

Why choose physical gold over ETFs, funds or digital tokens?

Physical gold gives you direct, tangible ownership that isn’t exposed to counterparty risk. ETFs and tokens track prices but do not provide legal title to metal. With Goldwise, you own real, allocated metal stored in insured vaults.

How much gold or silver should I buy?

It depends on your personal financial goals and diversification needs. Many investors allocate 5–10% of their portfolio to physical precious metals as a long-term hedge against inflation and market volatility.

Can I take delivery of my gold or silver?

Delivery options for selected coins and bars are being introduced soon. For most investors, insured vault storage remains the safest and most efficient option.

View our Help Centre for more articles of support.

GOLDWISE CONNECT

For Wealth Platforms

Enable your customers to trade physical Gold, Silver, Platinum & Palladium – 24/7

Enterprise-grade Trading Technology, Institutional Liquidity and Physical Allocation